Was deep into the rational that Delphi Digital Labs used for picking the chain they will focus upon for now and decided I would just post my raw notes that I make for discussing things on our show, because it might be of interest.. or not.

Finding a Home for Labs by Delphi Digital

- Delphi Labs Chain Choice

- Labs builds new primitives for Web3

- Were on @terra_money and that was a mistake, so took time to decide on next platform

- Focused on DeFi

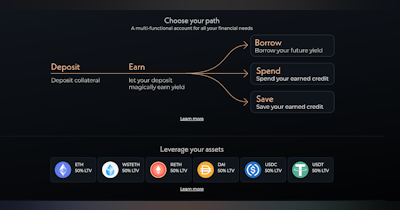

- Believe that DeFi will be bundled into a single integrated UX like a CEX with a universal DeFi credit account/line. Wanted ecosystem that could do that.

- Believe projects will specialize with more multi-chain than monolithic

- Monolithic chains = blockspace supply outstrips demand = high fees/congestion = bad UX

- This results in uncertain/high costs for use

- Example: Gaming can be stopped with congestion/high fees

- Add blockspace vertically will still get filled

- Monolithic means must accept the choices of the chain & tradeoffs that go with

- Custom chains/subnets = better control of how functions for the benefit of their project

- Custom fee models for each make it better. Multiple fee tokens or any fee tokens.

- Custom MEV solutions to control prioritization of tx

- More benefits: Privacy, performance, validators take on more services

- Off-chain compute flexibility

- Disadvantages of customization

- Time, effort, cost to build and maintain

- Lack of synchronous composability

- "evolve into a mesh network of interconnected specialised chains/rollups organised into clusters around specific use cases"

- So think DeFi gets bundled, but chains get fragmented

- DeFi hubs for subchains, so subchains deploy economics onto the hubs. Bridges from suburbs(subchains) to the city(DeFi hubs).

- Winning dapps will deploy on several hubs to compound liquidity across chains

- Cross chain dapp strategies

- 1. Standalone on each chain with separate liquidity, integrations, etc.

- 2. One unified app-chain with all liquidity like THorchain & Osmosis

- 3. A third option they see - Deployed instances on multiple chains, but connected via coordination layer for communication and liquidity. Something they are exploring with their protocol Mars.

- Benefits of 3.

- LPs deposit once and earn across all chains

- Allows primitives to be synchronously composable with other dapps on each chain with better performance

- Their primary requirements

- Speed - closer to CEX level

- Ecosystem - need lots of apps to integrate/composability

- Other requirements

- Decentralization - balance between performance and security

- Cross-chain introperability

- Technical maturity - Solana sucks

- Portability of code

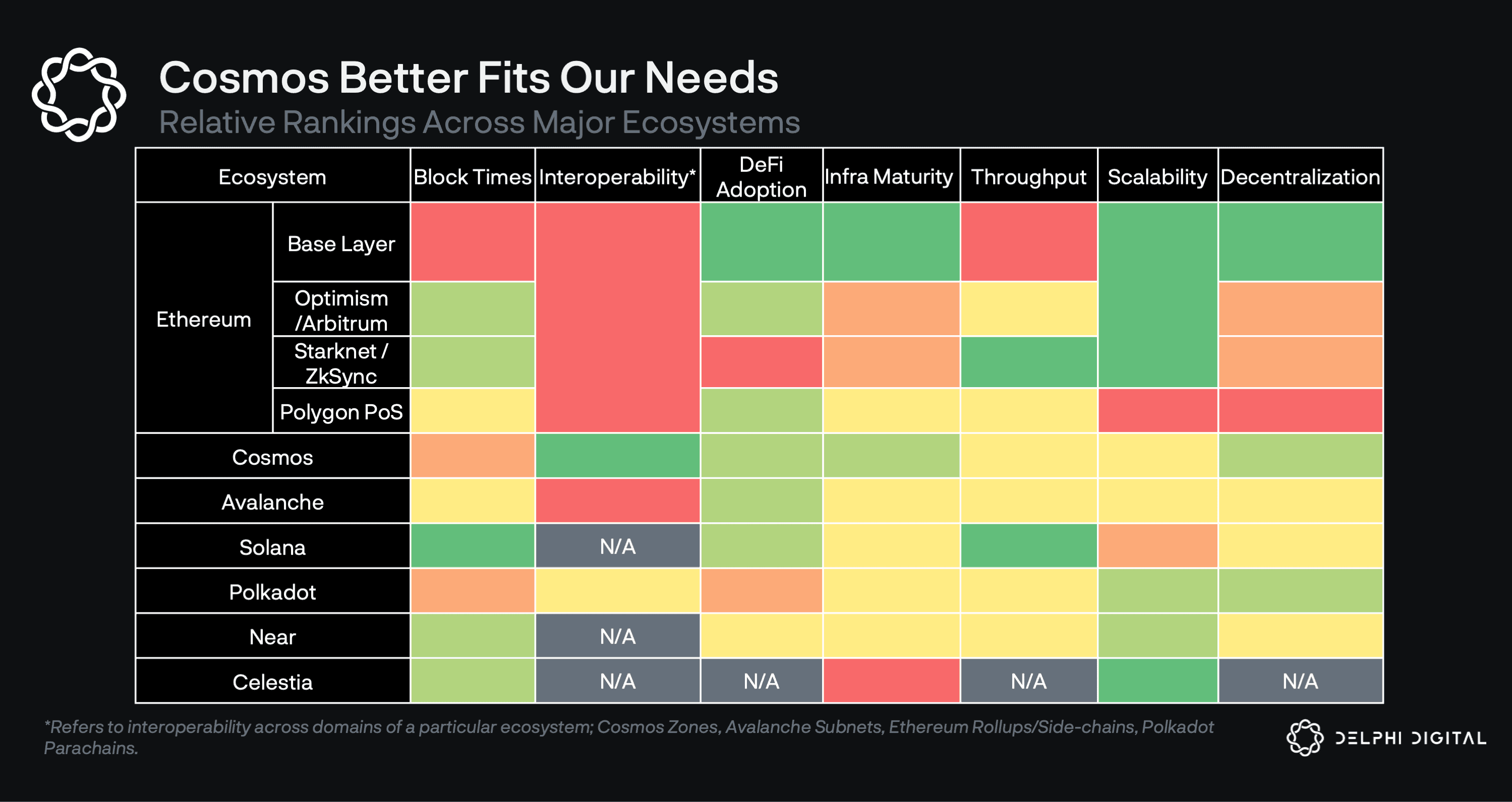

- Essentially decided that because cosmos was close on most, that it wins for their development efforts

- My take: Delphi is a big deal, so choosing this means that it may drive more volume and solve the low adoption problem

- Ethereum L1 - Speed and cost killed it

- Eth Rollups - Centralized sequencers & interoperability killed it

- EVM ORUs - Performance requires mutliple rollups which makes interoperability more difficult

- ZK Rollups - Think ZK crucial to future. Difficult to predict gain in marketshare for use. Not ready for primetime, some require specific language(stark) and lack of expertise means risk of bugs, etc.

- Modular (Celestia Rollups) - Promising, but not enough adoption. Keep an eye on it, but not ready yet. They do like cross chain and the fact that it eliminates need for separate validators on each chain built with it.

- Polkadot - Shared security is good. Very decentralized with 996 validators. Lots of devs, but user adoption isn't great. No significant advantages over Cosmos or rollups at this time.

- Fast Monoliths - Solana, Sui, Aptos - Something considered despite the monolithic model

- Solana - Congested, but fast and decentralized. Too many problems and cost planning is difficult. Other fast monoliths coming on.

- Aptos / Sui - Like Move language and speed of execution along with security. immature DeFi ecosystems, community, connectivity and substantial technical risk.

- Polygon - Speed and strong ecosystem are great. Opaque & centrlized governance decisions - gas price increase by 30x. Validators not permissionless. Only 100 nodes and no auctions to replace. Starting to decentralize now. Small committee controls billions in bridge from ETH to Polygon. See it as ecosystem instead of 1 chain. Polygon scored second highest among the options. Bridge and PoS chain as main were reasons not.

- Near - Sharding is differentiator - Highly scalable. Sharding causes problems. Smart contracts comms asynchronous, because may not be in same shard. That and small ecosystem make it a no.

- Avalanche - Similar to Cosmos. Really like the subnets. Start on main and move to own after mature. Lots of nodes, but weighted by staked amount = not as decentralizsed. New ecosystem, cross-subnet, infra tooling, and dev community are immature.

- Cosmos - Ecosystem of interoperable blockchains connected by IBC protocol

- Cosmos SDK makes it possible for new chains to ramp up with everything they need - Cantos

- Substrate from Polkadot similar, but not as mature and not as many chains & requires approval whereas Cosmos chains can interoperate when they want and no approval required by the Hub. dydx moved there.

- Trust only required between the chains reduces attack vectors. IBC also provides interchain accounts so users can use one account on many chains. No need to move tokens across.

- Interchain queries to query states cross chain.

- Cosmos ecosystem is still small. Under $1b TVL. Terra collapse killed TVL. Some Terra projects launching own chains & others launching on other Cosmos chains. dydx is most notable.

- Building there is a bet on future growth.

- Some chains have mediocre performance while others are faster shows how teams can improve their chain's consensus.

- Nakamoto Coefficient (number of colluding entities it takes) - 7-10 for most Cosmos chains. Ethereum - 2 Solana - 31

- Also multiple independent funded developer teams building on core. Proven decentralization model.

- Chose Cosmos, but open-minded about others